We are swimming in natural gas. Stockpile levels in storage facilities across the continent are at levels far higher than normal coming out of the winter season, all while domestic production still hovers near record highs despite active rig numbers falling out of the sky. Pair this with an abnormally warm and mild winter, and we are left with a supply/demand overhang that has pushed natural gas futures prices into record low territory. During last year’s selection period many suppliers – including ourselves – were confident that the market had bottomed out, and then it continued to fall.

CIG – ROCKIES

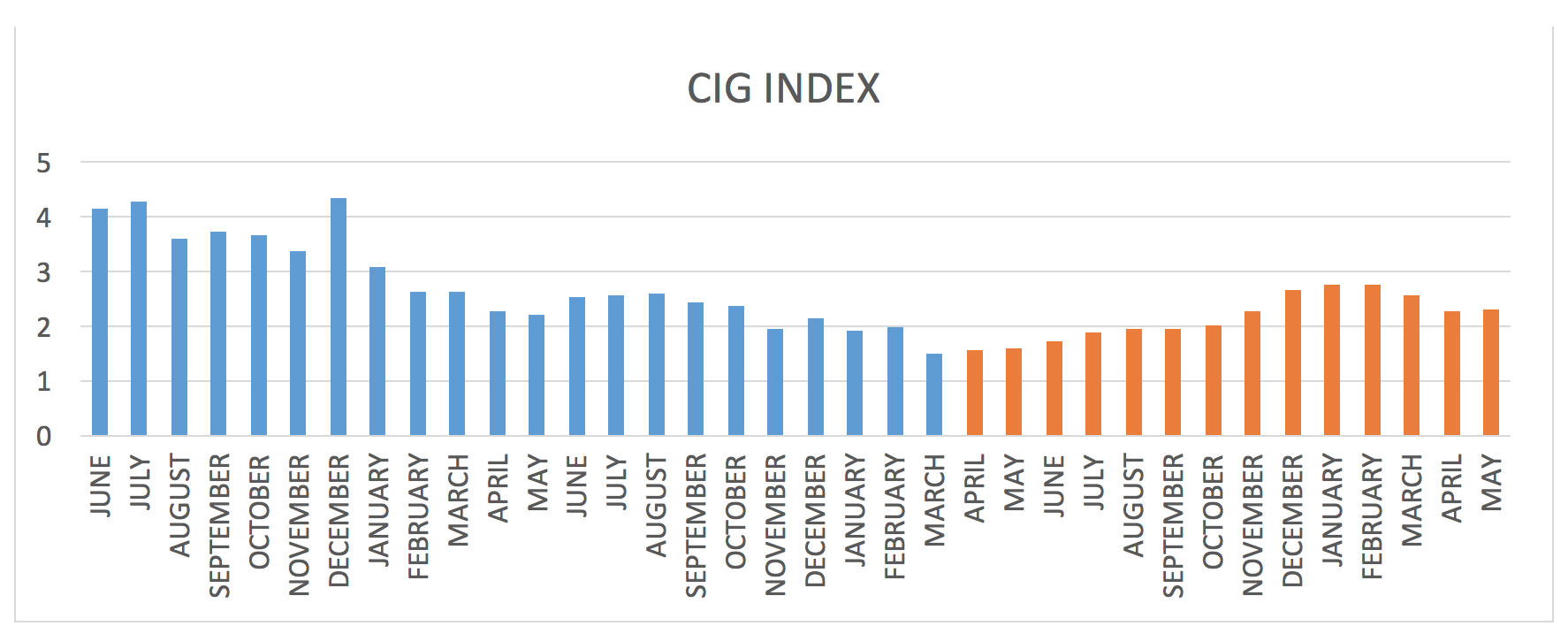

In central and eastern Wyoming, the primary price index for natural gas is called the Colorado Interstate Gas, or “CIG”, Index. This price index is driven by trade activity and expectations surrounding production and weather trends, and it will fluctuate from one month to another. Here’s a graph of the CIG Index over the last two years in blue, followed by currently traded prices over the next Choice Gas selection period of June 2016 to May 2017, shown here in orange:

You can see that prices have been falling pretty steadily, but that they are looking to begin drifting upward again for the coming selection year, with an average of about $2.25 per dekatherm, or $0.225 per therm as you we say at a consumer level.

In the near future, we’ll take a look at all the new pricing options you’ll be seeing this year next time. Until then, we’ll keep on moving Wyoming resources to Wyoming customers.